The Increasing Demand of Financial Offshore Wealth Strategies Among Affluent Individuals

The Increasing Demand of Financial Offshore Wealth Strategies Among Affluent Individuals

Blog Article

Exploring the Secret Advantages of Making Use Of Financial Offshore Provider

In the realm of global finance, the tactical use of offshore economic services provides distinctive benefits, specifically in the locations of tax obligation optimization and asset security. These services not just make certain confidentiality yet likewise supply a platform for varied investment chances that can lead to substantial monetary growth.

Tax Optimization Opportunities in Offshore Jurisdictions

While checking out economic overseas solutions, one substantial benefit is the tax optimization opportunities available in overseas territories. Many overseas financial centers impose no capital gets tax obligations, no inheritance tax obligations, and provide reduced company tax obligation rates.

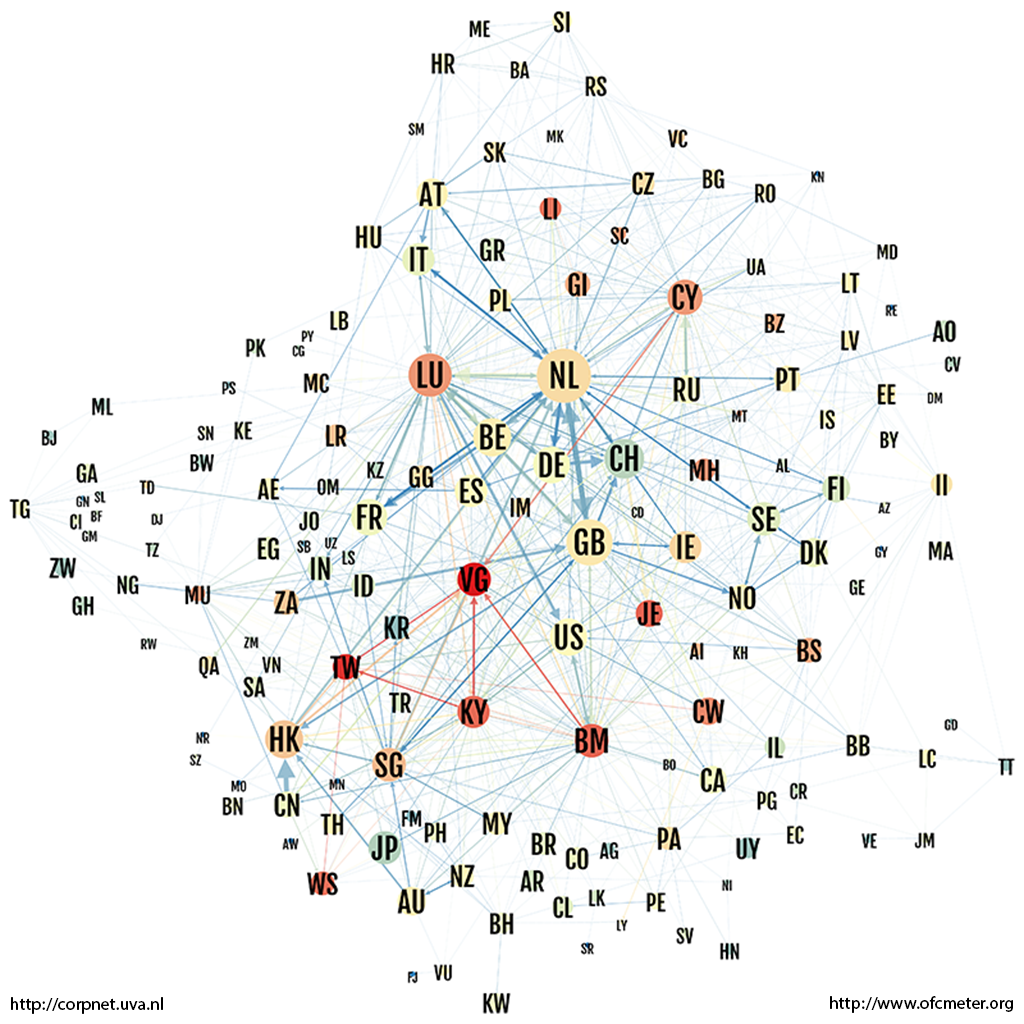

In addition, territories such as the Cayman Islands, Bermuda, and the Island of Male are renowned for their competitive tax obligation regimens. They give a lawful structure that promotes global organization procedures without the heavy taxation normal in the financiers' home countries. Making use of these possibilities calls for cautious preparation and adherence to international tax legislations to make certain compliance and make best use of advantages, making the proficiency of specialized economic advisors vital in browsing the intricacies of offshore monetary tasks.

Enhancing Personal Privacy and Possession Security With Offshore Services

Numerous individuals and corporations transform to overseas solutions not only for tax benefits however additionally for enhanced privacy and possession security. Offshore jurisdictions often have rigorous discretion regulations that avoid the disclosure of individual and economic info to 3rd celebrations. By positioning assets in overseas counts on or firms, they can legally protect their wealth from creditors, lawsuits, or expropriation.

Diversification and Danger Administration With International Financial Platforms

In addition to boosting personal privacy and asset security, offshore economic solutions use considerable possibilities for diversity and risk monitoring. By assigning properties across various global markets, investors can lower the effect of regional volatility and systemic dangers. This global spread of financial investments aids alleviate potential losses, as adverse financial or political developments in one area may be stabilized by gains in another.

Furthermore, the use of global monetary systems can offer beneficial currency direct exposure, boosting portfolio efficiency through currency diversity. This technique profits from variations in currency worths, potentially offsetting any residential currency weak points and more maintaining financial investment returns.

Verdict

To conclude, financial overseas solutions present significant advantages for both people and organizations by offering tax obligation optimization, boosted privacy, asset security, and danger diversification. These solutions facilitate calculated monetary planning and can bring about substantial growth and conservation of wide range. By leveraging the one-of-a-kind benefits of overseas territories, stakeholders can attain a more secure and reliable Get More Info management of their financial resources, tailored to their specific demands and objectives.

In the world of international finance, the critical usage of overseas monetary solutions presents unique benefits, particularly in the areas of tax optimization and possession protection.While discovering monetary offshore services, one considerable advantage is the tax obligation optimization opportunities readily available in overseas territories. Numerous offshore economic centers enforce no resources gains taxes, no inheritance tax obligations, and supply reduced company tax prices - financial offshore. Utilizing more information these opportunities calls for careful preparation and adherence to worldwide tax regulations to make sure compliance and maximize advantages, making the know-how of specialized financial advisors essential in navigating the intricacies of overseas economic tasks

Report this page